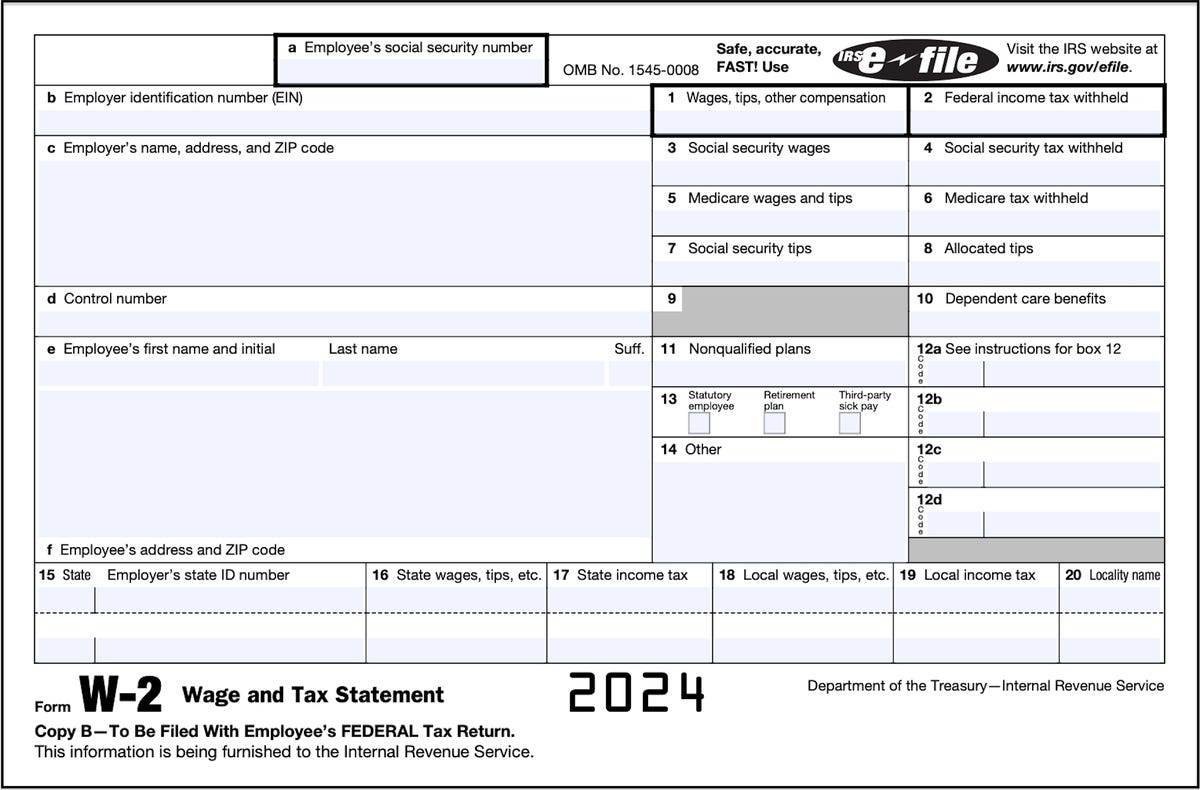

Tax Form 2024 2024 – The IRS begins to accept and process federal tax returns. Jan. 31, 2024 This deadline is for employers who must mail or furnish W-2 forms or 1099 forms to all employees who worked for them in 2023. . This part of the year brings a unique focus for those keeping an eye on their taxes, often juggling dual objectives. You might find yourself preoccupied with readying and submitting your 2023 tax .

Tax Form 2024 2024

Source : www.wolterskluwer.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comEverything to know before filing taxes in 2024, according to the

Source : www.masslive.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.comAV Now’s 2024 W 9 Tax Form — AV Now Fitness Sound

Source : www.avnow.comTax Season 2024: Here’s What to Do If You Haven’t Received Your W

Source : www.cnet.comEmployee’s Withholding Certificate

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comU.S. Expat Tax Deadlines for 2024: What You Need To Know

Source : 1040abroad.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comTax Form 2024 2024 IRS Releases 2024 Form W 4R | Wolters Kluwer: Employers generally are required to send the forms by the end of January. The IRS expects more than 128.7 million individual tax returns to be filed by the April 15, 2024 deadline. . Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The .

]]>